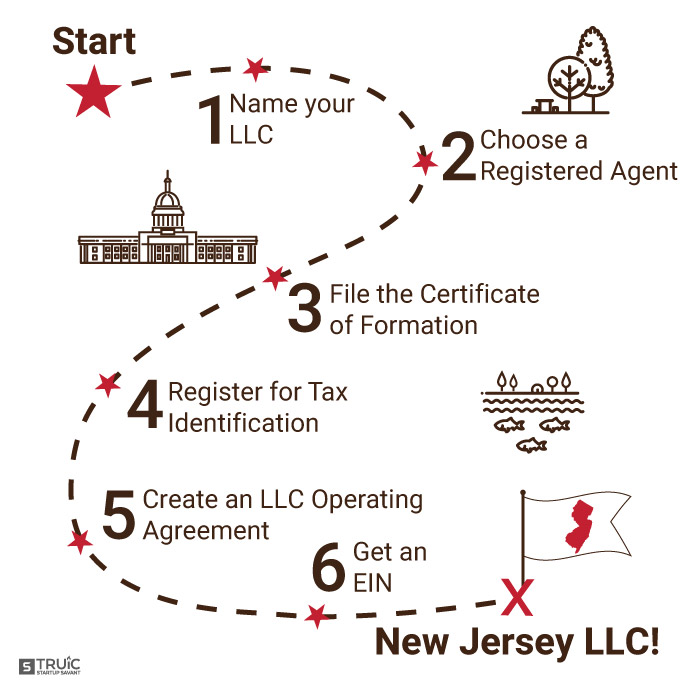

Forming an LLC in New Jersey takes just 6 easy steps that most people can follow successfully. The owner just needs to find the information, follow the instructions and within a few days he/she can have an LLC ready to do business.

Step 1: Create a name for the LLC

The LLC needs a name that complies with the business naming guidelines of the state. it's advisable to read those guidelines in order to comply. New Jersey law prohibits the use of a name that is already being used by, or is too similar to, another company in New Jersey. Availability of a chosen name can be checked at the New Jersey Business Record Service business name database.

Once a name is confirmed to be available, the next step is to reserve it for 120 days to make sure that no one else uses it while the owner is preparing to file the LLC. Name reservation is done at the New Jersey Division of Revenue & Enterprise Services for $50. The business owner is advised to get a domain even before the company is registered, to make sure no one else uses that domain.

Step 2: Appoint a registered agent

New Jersey law requires an LLC to have a registered agent, a NJ company or individual who will accept legal documents, tax forms, notices of lawsuits, and official government correspondence on behalf of the LLC. One of the LLC members can opt to be the registered agent.

Step 3: Complete the filing

To form a New Jersey LLC, the member must file a Public Records Filing with the NJ Department of Treasury, Division of Revenue & Enterprise Services. A preprinted form is available on the state's website which can be completed and filed in person, by fax or by post or online. Filing costs $125, but online filing costs an additional $3.50. In just over a week, the LLC will be formed.

Step 4. Prepare an operating agreement

An operating agreement is not a requirement in New Jersey but it is highly advisable in a multi-member LLC. It sets up how the LLC will be managed, and the rights and responsibilities of the members and the managers. In the absence of an operating agreement, state law will govern how the LLC operates. TRUiC has all the requisite information about creating an operating agreement on its websites. Read more...

Step 5: Register the LLC for taxes

Once the LLC has been formed, it must register with the New Jersey Division of Revenue and Enterprise Services. Then it will receive a New Jersey tax identification number and will receive all tax returns and notices in the future. Registration can be done by email or online.

If the LLC is going to have employees, or if it has more than one member, or if it chooses to be taxed as a corporation, it must get an EIN. This is done by completing an online application on the IRS website. No fee is required.

Step 6: Comply with regulations

The LLC may be required to obtain a state license, certification or permit before commencing operations, depending on the nature of the business. Details are available on the New Jersey Online License and Certification website.

The company may also need to obtain a local business license from the county or the city where its primary place of business is located. Information is available from the city/town office, the county offices or the local chamber of commerce.

Help is available

Anyone who wants to form an LLC but has no time to prepare the paperwork can get the help of an accountant or lawyer for a fee. Those who cannot follow the steps can seek the help of professionals such as lawyers or accountants and pay a fee for the service.

Share on Facebook

Share on Facebook